Posted date: December 4, 2024, 02:50.

Last updated: 04 Dec 2024 03:01h.

At the company’s investor day on Wednesday, Robinhood (NASDAQ:HOOD) CEO Vlad Tenev said the company is considering avenues to enter sports betting.

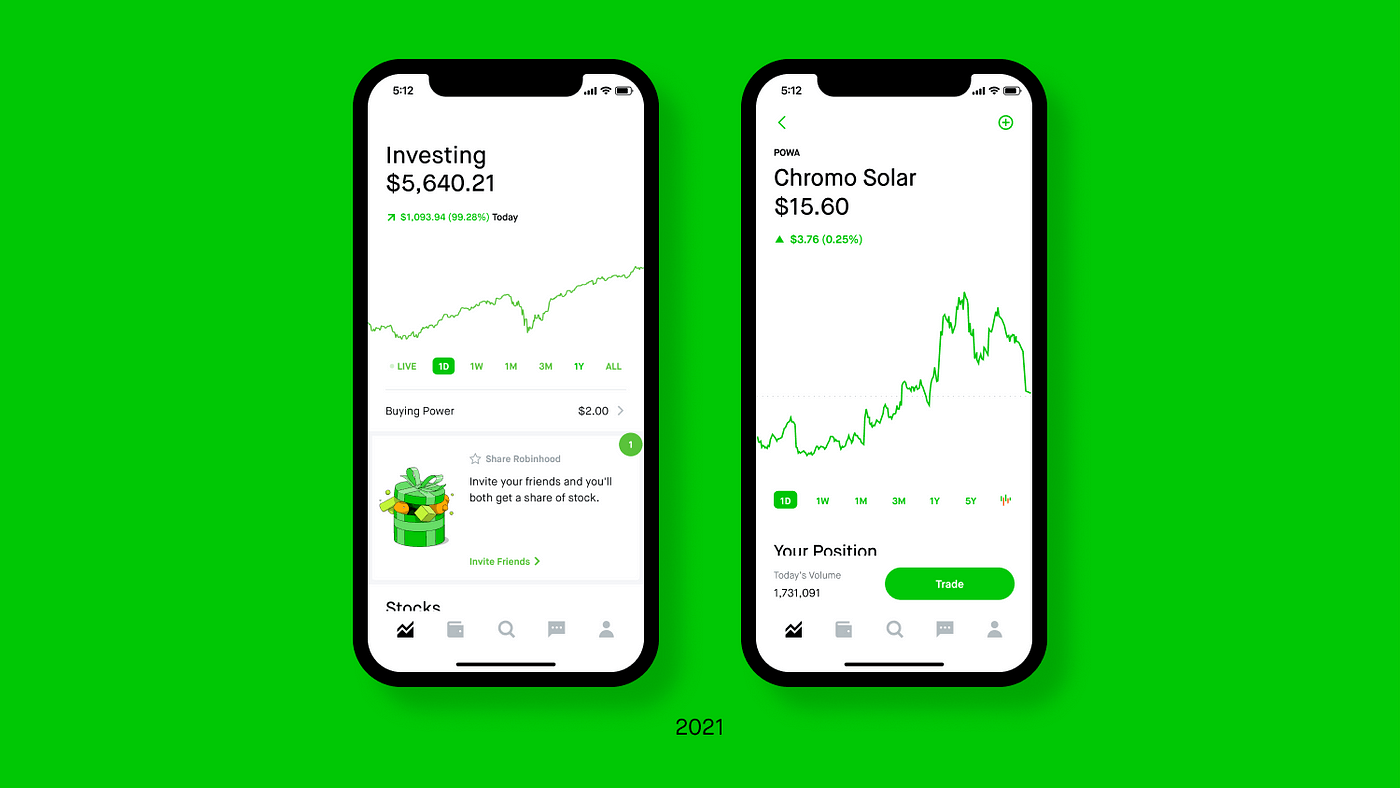

A sample image of the Robinhood investment app on a smartphone. The company is considering ways to enter sports betting. (Image: Robin Hood)

Tenev told shareholders that the provider of the popular investment mobile application is “actively looking” for ways to enter the sports betting space, allowing customers to bet on the equivalent of futures contracts on sporting events. He said he is interested in. This suggests that if brokerages move into sports betting, they will offer something different from traditional side bets and total bets.

Robinhood entered the event contracts space in late October, announcing an election betting service available only to U.S. customers approved for margin investing and Level 2 or 3 options trading. In an investor presentation, the financial services company said the event contracts it offers have funded more than 500,000 futures accounts and traded more than 500 million contracts in just one week. .

Robinhood listed event contracts in a “white space” category in its investor materials. This is an area where the company currently has limited penetration, but is expected to fill the void in the coming years.

Robinhood has the ideal sports betting demographic

Robinhood and sports betting may be an ideal pair for a variety of reasons, including the fact that the majority of trades on the trading platform are done via smartphones. The same goes for regulated sports betting in the United States.

Additionally, customer demographics align favorably with the sports betting sector. 80% of Robinhood’s customers earn between $50,000 and $100,000 or more than $100,000 annually. 75% are Millennials or Gen Z, and 60% are male. These age and income ranges are highly coveted by sportsbook operators.

Robinhood has also proven adept in another area related to sports betting: customer retention. This is likely a byproduct of switching costs and tax issues associated with transferring brokerage accounts, but Robinhood’s customer retention rate was about 95% as of October, up from 80% two years ago.

The average customer has about $6,500 in assets on Robinhood, a number that has doubled in the past two years, according to an investor presentation.

Robinhood customers are primed for sports betting

Two other asset classes, cryptocurrencies and options, confirm that Robinhood and sporting event contracts may be an ideal match. Options trading on the platform has skyrocketed, and the company rolled out stock index options last month.

When it comes to cryptocurrencies, which are loved by young investors and many sports bettors, Robinhood funds approximately 12 million crypto accounts with a total of $21 billion in assets under custody.

Robinhood is already one of the largest platforms in terms of nominal crypto trading volume among retail traders, reaching $85 billion in the third quarter despite offering just 20 digital assets. I did. By comparison, Coinbase’s nominal retail volume was less than twice that of Robinhood, and the number of tokens was 13 times that.